We are well into January and it’s the perfect time to take a fresh look at our money habits and find ways to save more. Whether you want to create an emergency fund, pay off debts, or invest for the future, 2024 is a great opportunity to reassess your financial goals.

Here are some simple tips to help you save money and achieve financial success this year:

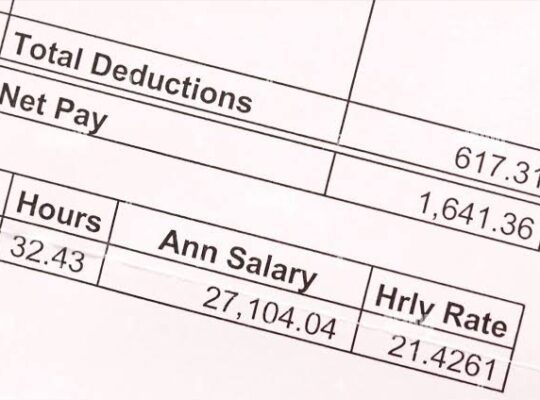

1. Make a budget and stick to it. Start by looking at how much money is coming in and going out. Creating a practical budget helps you see where you can make adjustments to save more. Use budgeting apps or tools to keep track of your spending.

2. Save for emergencies. Life can be unpredictable, so it’s important to have some money set aside for unexpected expenses. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This emergency fund acts as a safety net.

3. Cut unnecessary expenses. Take a look at your monthly subscriptions, services, and discretionary spending. Identify areas where you can make cuts without drastically changing your lifestyle. Cancel unused subscriptions, shop smarter, and find cheaper alternatives.

4. Negotiate bills and expenses. Don’t be afraid to negotiate with service providers for better deals on utilities, insurance, and other regular expenses. Sometimes, loyalty pays off, and companies may offer discounts to keep your business. Do some research to find lower rates and use them as leverage.

5. Automate savings. Make saving a habit by setting up automatic transfers to your savings or investment accounts. This way, a portion of your income goes directly towards your goals before you have the chance to spend it.

6. Pay off high-interest debts. High-interest debts can have a big impact on your finances. Prioritize paying off credit cards and loans with the highest interest rates. Consider debt consolidation or try negotiating lower rates to speed up repayment.

7. Find cost-saving opportunities. Look for ways to reduce everyday expenses, like carpooling, using public transportation, or choosing energy-efficient appliances. Small adjustments in your lifestyle can add up to significant savings over time.

8. Invest wisely. Explore investment opportunities that align with your goals and risk tolerance. Diversify your portfolio to spread risk and consider long-term strategies. Take advantage of retirement plans offered by your employer and accounts that come with tax advantages.

9. Educate yourself about personal finance. Stay informed about financial trends, investment options, and money management strategies. Continuous learning empowers you to make informed decisions and adapt to changes in the economy.

10. Review and adjust. Regularly revisit your financial goals and adjust your strategies as needed. Life circumstances and economic conditions change, so it’s important to be flexible and proactive with your finances. Remember, even small and consistent efforts can lead to significant savings over time. Take control of your financial well-being and set the stage for financial success not just this year, but in the years to come.