What are SMART financial goals?

When using the SMART goal-setting method, use the following criteria:

1. Be SPECIFIC. Avoid setting broad goals like “I will become financially stable in 2024.” Instead, think about the specific actions you need to take. For example, set a goal to pay off a portion of your largest debt.

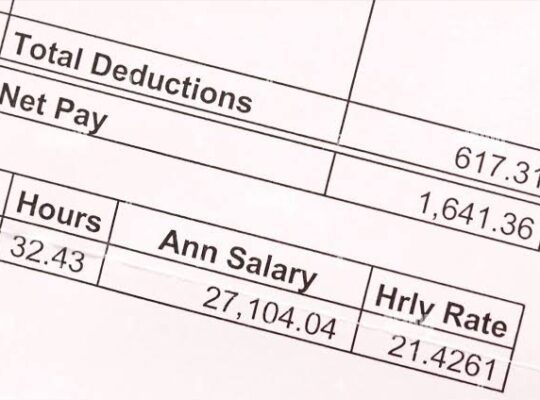

2. Make it MEASURABLE. Set targets with numbers so you can plan and track your progress. Calculate how much you can allocate each month towards debt payments. Divide your total debt by 12 to determine the monthly amount. Measure your progress monthly and halfway through the year.

3. Ensure it’s ACHIEVABLE. Set realistic goals that you can accomplish. Make your resolutions specific and actionable to stay motivated. For instance, aim to put R1500 from each paycheque towards paying off credit card debt.

4. Keep it REALISTIC. Consider your budget and financial priorities when setting goals. Paying off a large sum of debt in a short period may not be realistic if you have other financial responsibilities. Take your income and expenses into account.

5. Set a TIME deadline. Give yourself a time frame to stay focused. Determine how much you need to set aside each month to reach your goal, and track your progress over time. This way, you can avoid last-minute rushes to meet your year-end target.