It’s that time of year again—when we set our New Year’s Resolutions for 2024. If you’re like me and your bank account is down a bit from gift-giving during the holidays, it might be a good time to think about how you can give back to yourself financially.

Here are 10 SMART financial goals to consider this year.

- Build an emergency fund. Start saving bit by bit to create a safety net for unexpected expenses like job loss or car repairs. Aim to cover three to six months of expenses as your goal.

- Start a “fun fund”. Set aside money for big purchases or travel instead of relying on credit cards. Be intentional about your savings and avoid overspending on everyday expenses.

- Take a financial course. Learn about saving, investing, and taxes through free courses to enhance your financial knowledge and make informed decisions.

- Utilize credit card rewards. If you’re a loyal customer or love to travel, make sure you’re getting rewarded for it. Use rewards credit cards to earn points or cash back to offset expenses or pay off your bills.

- Catch up on unpaid taxes. Make paying off any outstanding taxes a goal for 2024. Consulting with an accountant can help you navigate this process.

- Hire a financial planner. Seek guidance from a financial planner to clarify your goals and create a comprehensive plan tailored to your needs. This can range from tax planning to pension management.

- Invest your money. Consider putting your money into investments to benefit from compound interest and grow your wealth. Speak with a financial advisor if you’re new to investing.

- Make a will. Secure your assets and ensure your wishes are met by creating a legal will. This protects your loved ones from unnecessary stress during difficult times.

- Get critical illness and disability insurance. Protect yourself financially in case of a severe illness or injury that prevents you from working. Insurance coverage can provide support during challenging times.

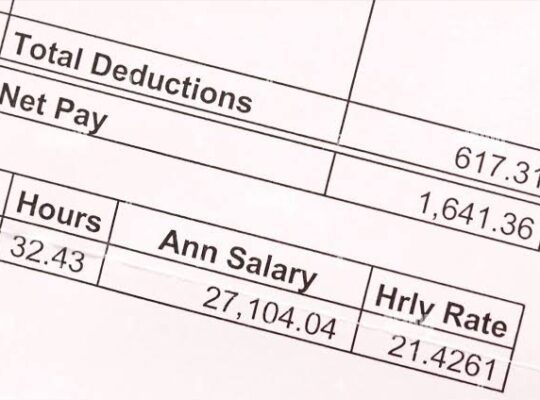

- Hire an accountant for tax assistance. If you have a self-employed business or side hustle, working with an accountant can help optimize your taxes and ensure compliance with tax laws as your income grows.