In the world of personal finance, bad debt is like an unwelcome guest that overstays its welcome. But what exactly is bad debt, and how can you keep it from disrupting your financial well-being in 2024?

Defining Bad Debt

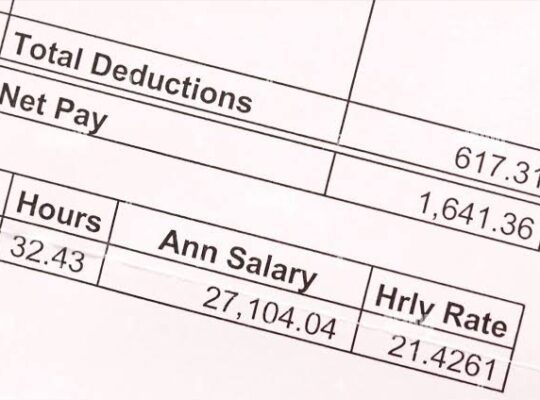

Bad debt refers to money borrowed for non-appreciating assets or items that don’t contribute positively to your financial future. Examples include high-interest credit card debt for non-essential purchases or loans for depreciating assets like a brand-new car.

Avoiding Bad Debt in 2024

1. Differentiate between Good and Bad Debt. Understand that not all debt is bad. Mortgages or education loans, for instance, can be considered investments in appreciating assets. Differentiate between debts that can potentially enhance your financial situation and those that may lead to financial strain.

2. Create a Realistic Budget. Establish a detailed budget that outlines your income, expenses, and savings goals. This can help you allocate funds wisely, reducing the likelihood of unnecessary and impulsive borrowing.

3. Emergency Fund. Build and maintain an emergency fund. Having a financial safety net can prevent you from resorting to high-interest loans or credit cards when unexpected expenses arise.

4. Prioritize High-Interest Debt. If you already have debts, prioritize paying off high-interest ones first. This approach minimizes the overall interest paid, freeing up resources for other financial goals.

5. Responsible Credit Card Use. Use credit cards responsibly. Avoid carrying a balance whenever possible, as high-interest rates can quickly turn small balances into significant debts. Paying your credit card balance in full each month is a key strategy.

6. Smart Purchasing Decisions. Before making a purchase, especially a significant one, consider its long-term impact on your finances. If it doesn’t align with your financial goals, it might be best to reconsider.

7. Regularly Review Finances. Regularly review and assess your financial situation. This includes checking your credit report, understanding your debt-to-income ratio, and making adjustments to your financial plan as needed.

8. Educate Yourself. Stay informed about personal finance. Understanding the financial products and services available, along with their implications, can empower you to make more informed decisions.

In conclusion, avoiding bad debt in 2024 requires a combination of financial awareness, responsible decision-making, and strategic planning. By adopting these practices, you can work towards a healthier financial future and steer clear of the pitfalls associated with bad debt.