Retirement is a significant milestone that brings a sense of accomplishment and a new chapter in life. It is crucial for retiring professionals to navigate this financial transition carefully, ensuring a stable and comfortable future.

1. Retirement Planning

Planning for retirement should ideally start early in a professional career. It is never too early to consider the future. Here are some essential pointers to keep in mind:

a) Set clear retirement goals: Define what you envision for your retirement years. Consider factors like lifestyle choices, travel plans, healthcare, and any financial commitments. Having concrete goals will guide your savings and investment decisions.

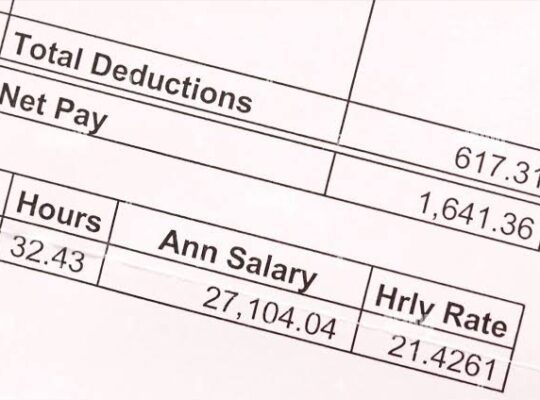

b) Determine your retirement income needs: Calculate your expected expenses during retirement, including basic necessities, healthcare costs, leisure activities, and unexpected contingencies. Consider your current income and adjust for inflation to estimate your post-retirement financial requirements.

c) Make use of retirement accounts: Take advantage of workplace retirement plans, such as pension schemes and retirement annuities. Contribute regularly and maximize your contributions to benefit from employer matches or tax advantages. d) Diversify your investments: Build a well-balanced investment portfolio that aligns with your financial goals, risk tolerance, and time horizon. Consider consulting a financial advisor to explore diverse investment options that provide growth potential, while also lowering overall risk.

2. Mistakes Most Retirees Make with Their Pension/ Retirement Funds

Unfortunately, many retirees make common mistakes that can significantly impact their financial security. Avoid these pitfalls by staying informed:

a) Overspending in the early years: Resist the temptation to spend excessively once you retire. Take a conservative approach in the initial years, ensuring your savings last throughout your retirement. Create a budget and adhere to it, allowing for flexibility and unexpected expenses.

b) Ignoring healthcare costs: Underestimating healthcare expenses can result in financial strain during retirement. Allocate a portion of your retirement savings for medical costs and consider long-term care insurance to protect yourself and your loved ones from potential burdens.

c) Failing to adjust investment strategies: As you retire, it’s crucial to reassess your investment strategy. Shift towards a more conservative approach to safeguard your funds against market volatility. Regularly review and rebalance your portfolio to maintain a balanced asset allocation.

d) Ignoring taxes: Understand the tax implications of retirement income sources such as pensions, retirement account withdrawals, and Social Security benefits. Knowledge of tax-efficient withdrawal and distribution strategies can optimize your retirement funds.

3. Considerations on Whether to Take an Early Retirement

Early retirement may seem tempting, but several considerations should be evaluated before making a decision:

a) Financial readiness: Assess your financial situation thoroughly to determine if you have sufficient savings and investments to support an extended retirement period. An early retirement may necessitate a longer duration of self-support than originally planned.

b) Health insurance and benefits: Evaluate the impact of early retirement on your health insurance coverage and other employee benefits. Ensure you have a plan in place to bridge the gap until you become eligible for Medicare or other insurance options.

c) Social and mental preparedness: Reflect on how an early retirement will impact your social connections and mental well-being. Consider engaging in activities or hobbies that provide purpose and fulfilment during this new phase of life.

As a retiring professional you should proactively plan your personal finances to ensure a smooth and secure transition. By following the aforementioned tips on retirement planning, avoiding common pension mistakes, and carefully considering early retirement decisions, you can take control of your financial future. Remember, it’s never too late to start planning, so take charge of your retirement today and enjoy a well-deserved, financially stable future.