In South Africa, when couples decide to get married without a prenuptial agreement, they automatically enter into a marriage in community of property. This means that all assets and liabilities acquired before or during the marriage are considered jointly owned. While such a marriage offers financial benefits, it also entails important considerations.

1. Full Sharing of Assets and Liabilities:

In a marriage in community of property, both partners share all assets and debts equally. This includes pre-existing debts and future debts acquired by either spouse during the marriage. Consider the following points:

– Transparency: Be open and transparent about your financial situation, including debts, investments, and assets, to ensure both partners are aware of the financial standing.

– Joint Decision-making: Make joint financial decisions, considering the impact on both partners’ assets and liabilities.

2. Estate Planning and Wills:

Marriage in community of property affects estate planning. Consider these important aspects:

– Updating Wills: Review and update your wills to ensure that your assets are distributed according to your wishes. Discuss how jointly owned assets will be distributed in the event of one partner’s passing.

– Power of Attorney: Consider establishing power of attorney to ensure that both partners have legal authority to act on behalf of the other if necessary.

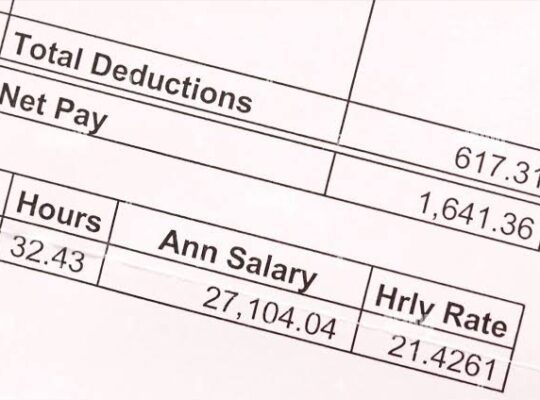

3. Credit Profiles and Debt:

Entering a marriage in community of property has implications for credit profiles and debt obligations:

– Credit Profiles: Understand that if one partner has a poor credit history, it may affect the creditworthiness of both partners. Jointly managing finances can help build a stronger credit profile.

– Debt Responsibility: Be prepared to take on responsibility for each other’s debts. It’s crucial to discuss financial habits, spending patterns, and a plan to manage debts acquired individually.

4. Protection against Business Risks:

If either partner owns a business, it’s essential to safeguard joint assets from potential business risks:

– Separate Business and Personal Assets: Consider creating a separate legal structure (such as a trust or company) to segregate business assets from joint assets in case of potential business liabilities.

– Consultation with Legal and Financial Advisors: Seek professional advice from legal advisors and financial planners to understand the best strategies for protecting joint assets.

5. Insurance Coverage:

Review your insurance coverage to ensure adequate protection for your shared assets and financial security:

– Life Insurance: Consider life insurance policies naming each other as beneficiaries to provide financial support in the event of one partner’s death.

– Home and Vehicle Insurance: Update policies to reflect joint ownership and ensure both partners are adequately covered.

6. Retirement Planning:

Marriage in community of property affects retirement planning. Consider these aspects:

– Retirement Contributions: Discuss how retirement contributions will be made and consider maximizing contributions to ensure a comfortable future together.

– Pension Funds and Retirement Annuities: Understand that these retirement investments form part of the joint estate and will be shared equally.

Entering into a marriage in community of property in South Africa involves full sharing of assets and liabilities. While it offers financial benefits, it also necessitates careful consideration from a financial perspective. By openly discussing financial matters, updating estate planning documents, being aware of joint debts and liabilities, protecting assets against business risks, reviewing insurance coverage, and planning for retirement together, couples can navigate the financial implications of this type of marriage and build a solid foundation for long-term financial security. Seeking professional advice from financial planners and legal advisors is highly recommended to ensure appropriate decision-making and understanding of all legal obligations.