Creating a financial plan is paramount to achieving your financial goals. While several components can be included, the following are essential:

- Clear Goals

Define short-term and long-term financial objectives. Whether it’s paying off debt, saving for a down payment, or retiring comfortably, setting specific goals will guide your financial decisions. - Cash Flow Management

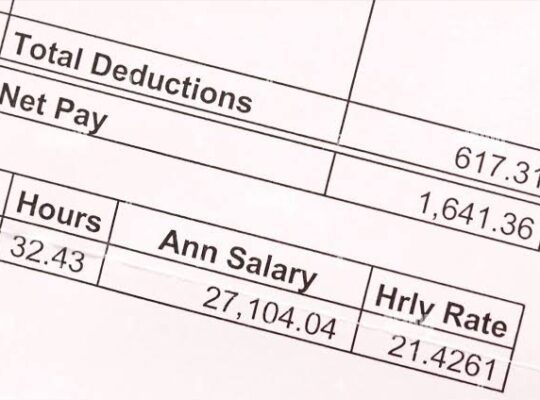

Monitor and manage your cash flow effectively by tracking your income and expenses. Identify areas where you can reduce expenses or increase income to improve your overall financial situation. - Budgeting

Develop a detailed budget that takes into account income, essential expenses, discretionary spending, and savings. Regularly review and modify your budget to ensure it aligns with your financial goals. - Emergency Fund

Set aside three to six months’ worth of living expenses in an easily accessible account. This fund acts as a safety net during unforeseen circumstances, providing financial stability. - Debt Management

Create a plan to actively manage and reduce any outstanding debts. Prioritize repayment based on interest rates and consider consolidating high-interest debts for easier management. - Investment Strategy

Research and develop an investment strategy aligned with your risk tolerance and financial goals. Diversify your investments to spread risk and maximize returns. - Tax Planning

Understand the tax implications of your financial decisions and seek ways to minimize your tax burden. Explore tax-advantaged savings accounts and investment vehicles to optimize your tax strategy. - Long-Term Wealth Creation

Look for opportunities to build wealth over the long term, such as investing in real estate, starting a business, or exploring alternative investment vehicles. Continuously educate yourself about wealth-building strategies to make informed decisions. - Professional Advice

Consider seeking guidance from a financial advisor or planner who can provide personalized advice and help you navigate complex financial matters. They can provide expertise and help you optimize your financial plan. - Regular Review

Set aside time to regularly review your financial plan to track progress, identify areas for improvement, and adapt to changing circumstances.

By including these components in your financial plan, you can pave the way towards a secure and prosperous financial future.